embedded machine learning research engineer - georgist - urbanist - environmentalist

- 80 Posts

- 263 Comments

2·5 months ago

2·5 months agoI got a positive one for you

9·5 months ago

9·5 months agoProperty taxes != Land value taxes

Further, it’s not a tax on capital; it’s a tax on land. It’s very explicitly designed to target land, as land has distinct economic properties that make it a prime target for taxation.

And yes, it does target speculative investments like those of Blackrock:

It reveals that much of the anticipated future tax obligations appear to have been already capitalised into lower land prices. Additionally, the tax transition may have also deterred speculative buyers from the housing market, adding even further to the recent pattern of low and stable property prices in the Territory. Because of the price effect of the land tax, a typical new home buyer in the Territory will save between $1,000 and $2,200 per year on mortgage repayments.

8·5 months ago

8·5 months agoThey are taxed, but I think they could be taxed more and better. Specifically, we should implement a land value tax (LVT).

As for why LVT? In short, it’s just a really good tax. Progressive, widely regarded by economists as “the perfect tax”, incentivizes efficient use of land, discourages speculation and rent-seeking, economically efficient, and hard to evade. Plus, critically regarding landlords, land value taxes can’t be passed on to tenants, both in economic theory and in observed practice.

As for the difference between LVT and property taxes? This video explains well how property taxes enable land speculation and disincentivize housing development, and how replacing them with land value taxes would alleviate these issues.

Further, even places (such as the Australian Capital Territory) that have implemented quite milquetoast LVTs have seen positive impacts on housing affordability:

It reveals that much of the anticipated future tax obligations appear to have been already capitalised into lower land prices. Additionally, the tax transition may have also deterred speculative buyers from the housing market, adding even further to the recent pattern of low and stable property prices in the Territory. Because of the price effect of the land tax, a typical new home buyer in the Territory will save between $1,000 and $2,200 per year on mortgage repayments.

123·5 months ago

123·5 months ago

21·5 months ago

21·5 months agoBetter than a wealth tax is a land value tax. Key properties are that it doesn’t cause capital flight (you can’t move land), it’s almost impossible to evade (you can’t hide land), it’s economically efficient (it literally doesn’t even harm the economy in the slightest to implement it), it can’t be passed on to tenants (both in economic theory and in observed practice), and it’s progressive.

Plus, it incentives denser, transit-oriented city development and disincentivizes wastage of prime real estate (which contributes to the housing crisis). All in all, a terrific policy that people aren’t talking nearly enough about imo.

10·6 months ago

10·6 months agoHow do so few people in this comments section see the obvious satire?? It’s clearly making fun of both landlords and absurd tipping culture.

3·6 months ago

3·6 months agoNon-paywall link: https://archive.is/psmPE

34·6 months ago

34·6 months agoIf they help to get people out of cars (including electric cars), I see them as a win. Orders of magnitude less impactful than cars.

16·7 months ago

16·7 months agoThe YIMBY movement (short for “yes in my back yard”) is a pro-Infrastructure development movement mostly focusing on public housing policy, real estate development, public transportation, and pedestrian safety in transportation planning, in contrast and in opposition to the NIMBY (“not in my back yard”) movement that generally opposes most forms of urban development in order to maintain the status quo.[1][2][3] The YIMBY position supports increasing the supply of housing within cities where housing costs have escalated to unaffordable levels.[4] They have also supported infrastructure development project like improving housing development[5] (especially for affordable housing[6] or trailer parks[7]), high-speed rail lines,[8][3]homeless shelters,[9] day cares,[10] schools, universities and colleges,[11][12] bike lanes, and transportation planning that promotes pedestrian safety infrastructure.[2]

YIMBYs often seek rezoning that would allow denser housing to be produced or the repurposing of obsolete buildings, such as shopping malls, into housing.[13][14][15] Some YIMBYs have also supported public-interest projects like clean energy or alternative transport.[16][17][18][19]

The YIMBY movement has supporters across the political spectrum, including left-leaning adherents who believe housing production is a social justice issue, free-market libertarian proponents who think the supply of housing should not be regulated by the government, and environmentalists who believe land use reform will slow down exurban development into natural areas.[20] YIMBYs argue cities can be made increasingly affordable and accessible by building more infill housing,[21][22][23]: 1 and that greenhouse gas emissions will be reduced by denser cities.[24]

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it.[1] It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating.

Some economists favor LVT, arguing they do not cause economic inefficiency, and help reduce economic inequality.[2] A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income.[3][4] The land value tax has been referred to as “the perfect tax” and the economic efficiency of a land value tax has been accepted since the eighteenth century.[1][5][6] Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies.

LVT is arguably an ecotax because it discourages the waste of prime locations, which are a finite resource.[21][22][23] Many urban planners claim that LVT is an effective method to promote transit-oriented development.[24][25]

291·7 months ago

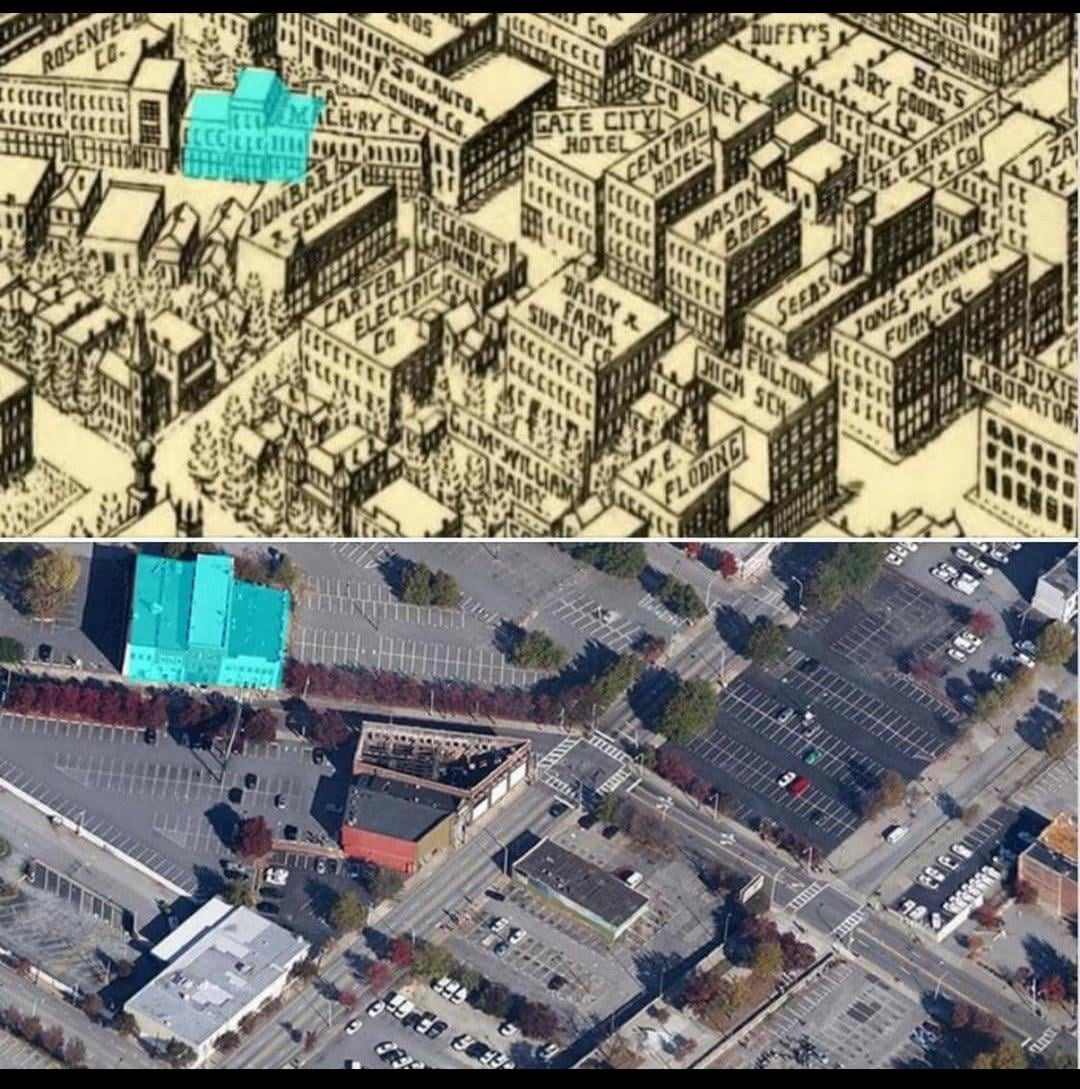

291·7 months agoParking minimums are legal requirements on the minimum number of parking spaces businesses and housing are allowed to have. The thing is these laws were developed using shoddy pseudoscience, are extremely arbitrary, and developed with maximum (rather than typical) usage in mind, meaning many developments have oversized parking lots, wasting valuable land. Further, old buildings that predate the parking minimums (and thus don’t have legally sufficient parking) can’t renovate or change usage without being legally required to build new parking, often by buying up a neighboring building and demolishing it to build a parking lot. This exact thing is why so many dense American and Canadian downtowns got bulldozed and turned into parking lots, like in the images below:

Atlanta

Tulsa

Kansas City

For more in-depth information on the insanity and idiocy that are parking minimums, see this video: https://youtu.be/OUNXFHpUhu8?si=KQbU00UPKw5GeNhQ

13·7 months ago

13·7 months agoIn fact, if you only truly need a car a handful of times per year, it’s vastly cheaper and less hassle to just rent it

21·7 months ago

21·7 months agoI agree that they’re already statistically safer in limited conditions; the key part is when/if they will surpass in a wide range of conditions, including heavy snow or the disorganized and often unmarked roads of developing countries, for instance. For what it’s worth, however, I do think the tech will eventually get there.

13·7 months ago

13·7 months agoThey’re not a solution simply because they’re still cars, and therefore take up the same grossly excessive amount of space as non-autonomous cars do.

Yeah, the only things autonomous cars might reduce are:

- Parking, but only if we forego our current private ownership model and everyone starts doing self-driving robo-taxis everywhere (unlikely)

- Road fatalities, but only if the self-driving tech proves statistically better than human drivers in a wide range of conditions (jury is still out)

It’s the same fundamental problem that electric cars have: geometry. Cars – even if electric and self-driving – are simply grossly inefficient at moving people for the amount of land they require:

7·7 months ago

7·7 months agoExactly, and I strongly suspect that most in-city accommodation can be done with neighborhood electric vehicles (NEVs)

30·7 months ago

30·7 months agoThis is basically how I like to put it:

171·7 months ago

171·7 months agoDowns-Thompson is inviolable.

The simple truth that a lot of people don’t understand. Cars simply require too much space that you can never possibly meet all the latent demand for car trips within a city, as doing so would mean bulldozing the entire city in the process. The only way to meet latent demand for transit is via an array of vastly more space-efficient means, e.g., public transit, walking, and biking.

75·7 months ago

75·7 months agoWhat’s ironic is my city, Montreal, is arguably the biggest cycling city in North America. Even in winter the bike lanes are filled with cyclists. Why? Turns out that all you need is good-quality bike infrastructure that you actually maintain in the winter and people will happily bike year-round.

4·7 months ago

4·7 months agoExactly. I’m in Canada, and I often ride my electric scooter to work in the winter, and many ride bikes in the winter here, too. The windshield on a glorified golf cart plus proper winter clothing is all you really need, although maybe detachable side flaps to keep out the wind might help, too.

And I wear full coat in a car anyways for the exact reason you mention: I still need to walk between car and final destination.

It’s not, though. The classical factors of production, whence we get the concept of “capital” as a factor of production, has land and capital as clearly separate:

https://en.m.wikipedia.org/wiki/Factors_of_production

And it’s an important distinction. The fact that land is not made and inherently finite makes it zero-sum. Meanwhile, the fact that capital such as education, tools, factories, infrastructure, etc. are man-made and not inherently finite makes them not zero-sum. This distinction has truly massive implications when it comes to economics and policymaking. It’s the whole reason LVT is so effective, so efficient, and so fair: it exploits the unique zero-sum nature of land.